Sep 3 2014

The rise of robotics is gaining traction much faster than most executives realize and will have a major impact on the competitiveness of companies and countries alike, according to new research by The Boston Consulting Group (BCG).

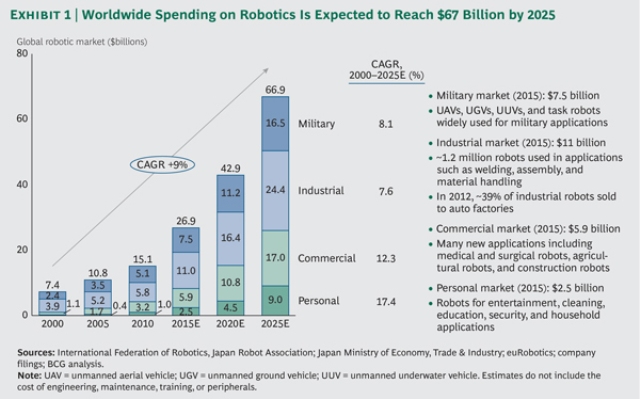

Exhibit 1 - Worldwide Spending on Robotics Is Expected to Reach $67 Billion by 2025

Exhibit 1 - Worldwide Spending on Robotics Is Expected to Reach $67 Billion by 2025

Spending on robots worldwide is expected to more than quadruple from just over $15 billion four years ago to about $67 billion by 2025 -- a 10.4 percent compound annual growth rate since 2010 -- according to BCG's study. The findings appear in a new article, "The Rise of Robotics," published on bcgperspectives.com.

Increasingly flexible, responsive, sensing -- even humanlike -- today's state-of-the-art robots are beginning to replace labor in a wide range of industries. As prices come down and new performance thresholds are crossed, robots are migrating from industrial and military uses to commercial applications and the personal-service realm, BCG says.

"Already used to fight wars, remove dangerous land mines, and fill customer orders, robots can also clean, dance, and play the violin; assist with surgery and rehabilitation; bathe elderly patients; measure and deliver medication; offer companionship; and provide disaster relief, report the news, and drive cars," the authors note.

BCG studied the full spectrum of the global robotics market, which comprises four sectors:

- The personal segment -- robots used for entertainment, cleaning, education, security, and household applications -- is projected to grow the fastest, at a compound annual rate of 15.8 percent, ballooning from $1 billion in 2010 to $9.0 billion in 2025.

- The commercial segment -- robots used for medical and surgical purposes, agriculture, and construction, among other applications -- is expected to grow at a compound growth rate of 11.8 percent from $3.2 billion to $17.0 billion, overtaking spending on military applications.

- The industrial segment -- robots used in applications such as welding, assembly, painting, and material handling -- will continue to be the largest, growing at a compound growth rate of 10.1 percent from $5.8 billion to $24.4 billion.

- The military segment -- for unmanned aerial, ground, and underwater vehicles, among other applications -- is projected to grow at a compound growth rate of 8.1 percent from 2010 to 2025 and will be second largest, at $16.5 billion.

It's interesting to note that 15 years ago, there was no significant market for personal robots and only a very small one -- $1.1 billion in 2000 -- for commercial applications. (See Exhibit 1.) Increasingly, robotic applications are migrating from industrial and military uses to commercial and personal ones. In June, for example, BP received approval from the U.S. Federal Aviation Administration to use drones to monitor the company's oil operations in Alaska. Honda is investing in robots that will provide assistance to people with mobility problems, such as the elderly and disabled.

Driving this growth is a convergence of falling prices and performance improvements. The cost of high-quality robots and components is dropping rapidly, while CPUs are getting faster and application programming is getting easier. As robots become cheaper, smaller, and more energy efficient, they gain flexibility and finesse, increasing the breadth of potential applications.

Consider, for instance, how robots are enabling food processors to make products untouched by human hands. At Sweden-based Charkman Group, robots slice and pack high volumes of salami, ham, turkey, rolled pork, and other cooked meats. They can handle 150 picks per minute across multiple sizes and types of meat.

"The fact that robotics and automation are crossing price, performance, and adoption thresholds is a clear sign that the robotic megatrend is growing in relevance and a tipping point may be near," said Alison Sander, head of BCG's Center for Sensing & Mining the Future and a coauthor of the article.

Where Demand Is Coming From

Demand for robots is currently highest in South Korea and Japan. Roughly 40 percent of the industrial robots used today are in the automotive sector, in which "robot density" (a metric indicating the number of robots per 10,000 manufacturing workers) already tops 1,000 in five countries -- Japan, France, Germany, the U.S., and Italy. China is the fastest-growing market for imported industrial robots, according to the article.

"Countries with a greater number of robotic programmers and robotic infrastructure could become more attractive to manufacturers than countries with cheap labor," said Mel Wolfgang, a senior partner in BCG's Industrial Goods practice and a coauthor of the study. "This rise and expanding reach of robots will fundamentally alter the competitive dynamics of the global economy."

Despite the potentially far-reaching implications of this trend, the authors argue that few companies have thought about how the next generation of robotics will affect their workforce, operations, business models, and competitive position. And even fewer have considered which approach to embracing robotics will deliver the most sustainable advantage.

The article includes a number of examples of companies that are leveraging robotics to build competitive advantage, including Philips, Rio Tinto, and Amazon.com. It also charts M&A activity showing new players entering the robotic field. Google, for example, has bought more than eight robotic-related companies in the last year, prompting speculation about the role robotics will play in its future, as Google already is a leader in self-driving cars.

Profiting from the Megatrend

To help companies prepare for and profit from the megatrend, the authors offer advice on how to identify areas for leveraging robotics. They also review four key strategic considerations.

"The megatrend toward mobile, autonomous, multipurpose, and bespoke robotics is gaining traction much more quickly than most corporate executives realize," the authors conclude. "Perhaps the greatest promise lies with the power of robotics to transform a company's value proposition -- and fundamentally change the competitive dynamics of any industry."

A copy of the article can be downloaded at www.bcgperspectives.com.

To arrange an interview with one of the authors, please contact Eric Gregoire at +1 617 850 3783 or [email protected].

About BCG's Center for Sensing & Mining the Future

The Center for Sensing & Mining the Future develops BCG's global-trend database and provides guidance to companies working to better understand trends that will shape their future. The center tracks more than 90 megatrends that cut across the latest technologies, demographic shifts, and economic developments. More than 600 clients across all industries and regions have benefited from the center's insights.

About The Boston Consulting Group

The Boston Consulting Group (BCG) is a global management consulting firm and the world's leading advisor on business strategy. We partner with clients from the private, public, and not-for-profit sectors in all regions to identify their highest-value opportunities, address their most critical challenges, and transform their enterprises. Our customized approach combines deep insight into the dynamics of companies and markets with close collaboration at all levels of the client organization. This ensures that our clients achieve sustainable competitive advantage, build more capable organizations, and secure lasting results. Founded in 1963, BCG is a private company with 81 offices in 45 countries. For more information, please visit bcg.com.

About bcgperspectives.com

Bcgperspectives.com features the latest thinking from BCG experts as well as from CEOs, academics, and other leaders. It covers issues at the top of senior management's agenda. It also provides unprecedented access to BCG's extensive archive of thought leadership stretching back 50 years to the days of Bruce Henderson, the firm's founder and one of the architects of modern management consulting. All of our content -- including videos, podcasts, commentaries, and reports -- can be accessed by PC, mobile, iPad, Facebook, Twitter, and LinkedIn.